Turning your real estate dreams into a reality often requires more than just ambition; it necessitates a strategic approach. In this article, we will embark on a journey from envisioning your real estate investments to making them a successful reality through the use of rental investment loans.

The Dream: Real Estate Investment

- Vision and Ambition

Every real estate journey begins with a vision. It’s about identifying your goals, whether it’s creating a passive income stream, building wealth, or diversifying your investment portfolio.

- Market Research

Understanding your target real estate market is crucial. Conduct thorough research to identify trends, opportunities, and potential challenges. This knowledge forms the foundation of your investment strategy.

- Financial Planning

Before diving into real estate, create a financial plan. Determine your budget, assess your risk tolerance, and outline your investment goals. This step ensures that your real estate aspirations align with your overall financial picture.

The Reality: Rental Investment Loans

- Introduction to Rental Investment Loans

Rental investment loans are specialized financial tools designed to help aspiring real estate investors turn their dreams into reality. These loans provide the capital needed to purchase investment properties, whether residential or commercial.

- Types of Rental Investment Loans

There are several types of rental investment loans to explore:

- Traditional Mortgages: These loans are suitable for long-term investment properties. They often require a down payment and offer competitive interest rates.

- Hard Money Loans: Ideal for quick acquisitions, hard money loans are asset-based and have shorter terms. They are popular among fix-and-flip investors.

- FHA Loans: If you plan to live in one of the units in a multi-unit property, an FHA loan may be an option with a lower down payment.

- Loan Application Process

Applying for a rental investment loan involves several steps:

- Preparation: Gather necessary financial documents, including income statements, credit reports, and property information.

- Loan Selection: Choose the type of rental investment loan that aligns with your investment strategy.

- Loan Approval: The lender evaluates your financial situation, creditworthiness, and the property’s potential. Once approved, you receive the loan.

- Property Purchase: Use the loan to acquire your investment property.

Achieving Real Estate Success

- Property Management

Successful real estate investment goes beyond acquisition; it involves effective property management. Ensure your properties are well-maintained, and tenants’ needs are met.

- Cash Flow Management

Rental income should exceed expenses to generate a positive cash flow. Proper budgeting and financial management are vital for success.

- Portfolio Diversification

Consider expanding your real estate portfolio over time to mitigate risk and enhance returns.

- Continuous Learning

The real estate market is dynamic. Stay informed about market trends, regulations, and investment strategies to make informed decisions.

Overcoming Challenges

The journey from dream to reality may encounter challenges:

- Market Volatility

Real estate markets can fluctuate. Be prepared to adapt your strategy when necessary.

- Financing Obstacles

Securing financing can sometimes be challenging. Maintain a strong credit profile and explore alternative lenders if needed.

- Property Selection

Choosing the right properties is crucial. Conduct thorough due diligence to avoid investment pitfalls.

In Conclusion

Real estate investment has the power to transform dreams into reality, but it requires careful planning, informed decision-making, and often, the support of rental investment loans. By combining your vision and ambition with the right financial tools and strategies, you can unlock the doors to real estate success.

From envisioning your real estate goals to navigating the loan application process and ultimately managing your properties with finesse, the journey from dream to reality is a fulfilling one. Real estate investment is not just about owning properties; it’s about creating a pathway to financial prosperity and achieving the life you’ve dreamed of.

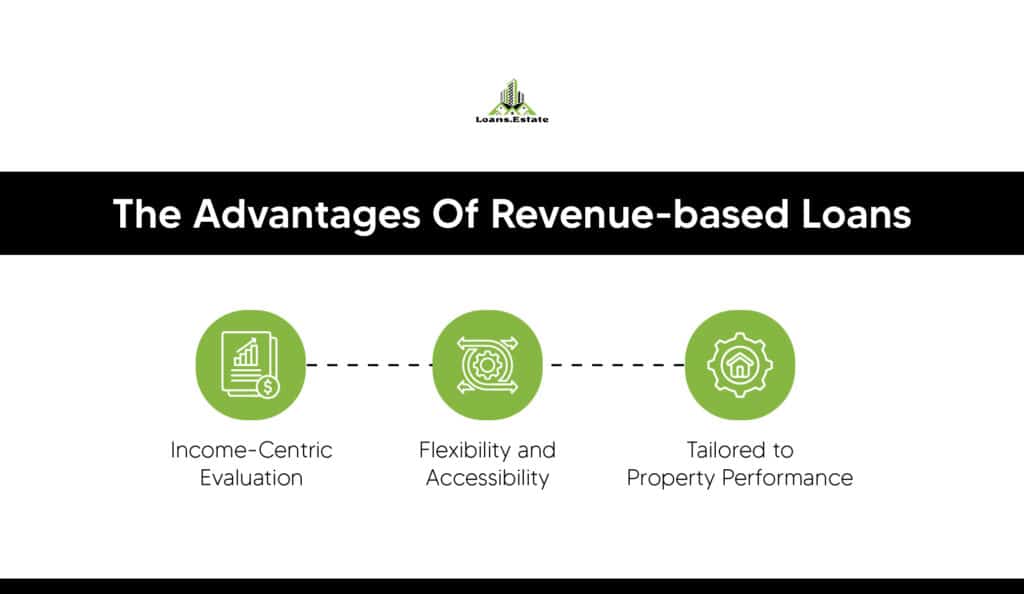

The Advantages of Revenue-Based Loans

The Advantages of Revenue-Based Loans Shaping the Future of Real Estate Investment with Revenue-Based Loans

Shaping the Future of Real Estate Investment with Revenue-Based Loans

The Advantages of Fix & Flip Loans Investments

The Advantages of Fix & Flip Loans Investments